SG Young Investment

A journey into the world of finance and investments. Learning how to manage money to achieve financial freedom. Making Finance simple in a complicated world

Sunday, December 11, 2022

Do I Still Believe In Financial Freedom?

Wednesday, September 21, 2022

Picking Growth Stocks With Investor-One Portfolio

Growth stocks are good additions to our portfolio to boost our investment returns over the long term. Most of the stocks in our portfolio will be average or even loss making but there may be 1 or 2 super growth stocks in our portfolio which boost our returns significantly.

An example of a growth stock is Netflix which grew by 145x if you invested in 2003. $10,000 invested in 2003 would be worth $1.45 Million now. Its a long 19 years but still the returns are exceptional at average of 763% annually. Another growth stock, Tesla grew by 146x in 10 years from 2012 to 2022. $10,000 invested in 2012 would be worth $1.46 Million now. While these growth stocks would have given our wealth a significant boost, the issue is always how do we pick winning growth stocks?

For Singapore market, there are also growth stocks. An example is iFast which grew 8x in just 2 years from 2020 to 2022. $10,000 invested in 2020 would have grown to $80,000 in just 2 years. The price of iFast have since retreated down but the returns are still about 4x-5x.

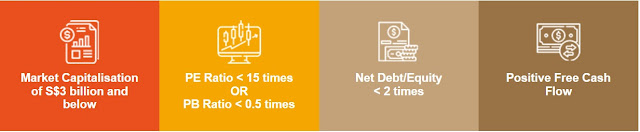

Investor-One, a website by ShareInvestor, has a portfolio feature where their research team manage a portfolio of stocks which are focused on growth. They select stocks based on a a set of fixed financial parameters as seen below:

These financial metrics seems reasonable to find undervalued companies which are not big market cap and with strong financial standings. Most of the companies which grew tremendously over the years had small market cap back then and they slowly grew to become big market cap companies such as Netflix.

On the Investor-One portfolio page, you will be able to find stocks which are in their portfolio and their recent buys for this portfolio. This portfolio is managed by ShareInvestor's Investor-One team. You will be able to see their portfolio returns too. For each stock buy, the team has also put up notes to explain the rationale of buying the stock. One example of a buy for HRnetGroup is seen below:

In the Investor-One portfolio, there are 7 stocks now. Some of the stocks are making money while some are in the red. This is part and parcel of investment and our view should always be for the long term and hope that the winners are more than the losers in the long run. I've learnt over the years that we can never be 100% correct for investments but some financial metrics will guide us to choose the right stocks. Buying companies which are overvalued is a sure way to lose money so its important to refer to some financial ratios such as Price to Earnings (PE) and Price to Book (PB) when choosing stocks to buy. While financial ratios may not be a full-proof way to make money, it does provide some guidance for us not to buy overvalued companies.You can check out Investor-One portfolio page which will be updated when there are new purchases and you'll be able to see how the portfolio performs over the years based on the above financial parameters.

This post is sponsored by ShareInvestor but all views are of my own

Sunday, August 28, 2022

The Ultimate Financial Independence Visualisation Tool

There's a saying that goes like this "If you fail to plan, you plan to fail". However, most of the time, you may be lost as to how to start your own financial planning to achieve financial independence (FI)? How do I even know how much income, expenses or investment return I must have in order to achieve FI? When is the age where I can finally say to my boss "I Quit"?

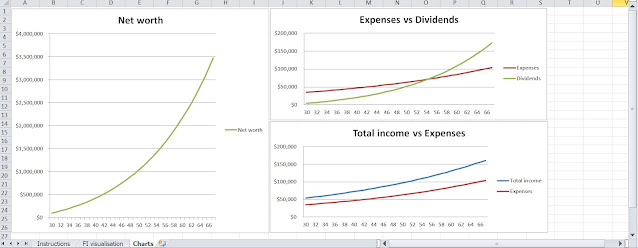

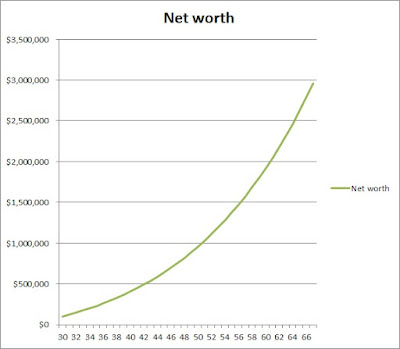

These are all relevant concerns which is why I created a financial independence visualisation tool which I use for my own financial planning also. I've made it easy to use so you can just input your age, income, current savings, expenses, target dividend yield, bonus, salary increment and emergency fund and the tool will calculate it all out for you.

Here's a screenshot of how the tool looks like in excel: